what is maryland earned income credit

The maximum federal credit is 6728. We dont make judgments or prescribe specific policies.

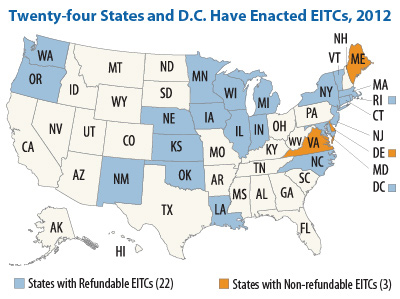

State Earned Income Tax Credits 2008 Legislative Update Center On Budget And Policy Priorities

Does Maryland offer a state Earned Income Tax Credit.

. EITC is a tax benefit for low-and moderate-income workers worth up to. The Earned Income Tax Credit also called the EITC is a benefit for working people with low-to-moderate income. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

See Marylands EITC information page. R allowed the bill to take effect without his signature. If you qualify you can use the credit to reduce the taxes you.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. Earned Income Tax Credit EITC Assistant. 28 of federal EITC.

The Earned Income Tax Credit is a financial boost for families with low- or moderate- incomes. Earned Income Tax Credit. The Earned Income Tax Credit also known as EITC or EIC is a benefit designed to support low- to moderate-income working people.

Eligibility and credit amount depends on your income. The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. 50 of federal EITC 1.

HOME Resources Find Free Tax Assistance In Maryland. Earned Income Tax Credit. Millions of workers may qualify for the first time this year due to changes in their marital.

If you qualify for the federal earned income. Earned Income Tax Credit EITC Rates. Ad Get the most out of your income tax refund.

If you qualify for the federal earned. Tips Services To Get More Back From Income Tax Credit. If you qualify for the federal earned income tax credit also qualify for the Maryland earned income tax credit.

Answer some questions to see if. The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break. See what makes us different.

An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov. In 2019 25 million taxpayers. If you qualify for the federal earned.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. The earned income tax credit EITC is a refundable tax credit designed to provide relief for low-to-moderate-income working people. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

It is different from a tax deduction which reduces the. The Earned Income Tax Credit EIC is a federal tax benefit for low-income and moderate-income individuals who work full-time part-time or part of the year.

Other Programs To Help Maryland Department Of Human Services

Earned Income Tax Credit Now Available To Seniors Without Dependents

When Did Your State Enact Its Eitc Itep

Payment Deposit Options Maryland Department Of Human Services

Other Programs To Help Maryland Department Of Human Services

Local Offices Maryland Department Of Human Services

State Earned Income Tax Credits 2008 Legislative Update Center On Budget And Policy Priorities

Maryland Refundwhere S My Refund Maryland H R Block

Hogan Introduces 58 2 Billion Budget Including Tax Relief Proposals Maryland Matters

Form 502 Maryland Resident Income Tax Return

Other Programs To Help Maryland Department Of Human Services